nj property tax relief fund 2020

Requires additional aid to be. The new jersey homeowner assistance fund.

We Help Taxpayers Get Relief From IRS Back Taxes.

. Senior Freeze Property Tax Reimbursement Program. On july 11 2022 at 900am the state rental assistance. The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program.

18 of your rent is used to calculate your share of property tax Per the state constitution Article VIII Section I paragraph 7 100 of. If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline. Forms are sent out by the State in late Februaryearly March.

About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion property tax relief program included in the. In New Jersey Murphy in recent years has billed his administrations push to better fund the state-aid formula for K-12 schools as a property-tax relief initiative. The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number.

Nj division of taxation subject. Capital gains on the sale of a principal residence of up to 250000 if single and up to 500000 if marriedcivil union couple. As an alternative taxpayers can file their returns online.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. NJ property taxes climbed again in 2020. For information call 800-882-6597 or to visit the NJ Division of Taxation.

Taxes collected under the provisions of this act shall be deposited by the State Treasurer in a special account to be known as the Property Tax. The filing deadline for the 2018 Homestead Benefit was November 30 2021. The support goes directly to.

Another nearly 300000 homeowners with incomes between 150000 and 250000 will be eligible to receive benefits totaling 1000. Prior to the new 51 billion budget the average property tax benefit was 626 with eligibility limited to homeowners making 75000 or less if under 65 and not blind or disabled. Homeowners should also be provided a way to pay their property taxes on a monthly basis to.

Increases distribution to municipalities from Energy Tax Receipts Property Tax Relief Fund over five years to restore municipal aid reductions. Renters can qualify for like 50 of property tax relief. Average bill more than 9000.

Ad See If You Qualify For IRS Fresh Start Program. We will mail checks to qualified applicants as. Capital gains in excess of the allowable exclusion.

Property Tax Relief Fund. Taxes collected under the provisions of this act shall be deposited by the State Treasurer in a special account to be known as the Property Tax Relief Fund. Free Case Review Begin Online.

How Bonuses Are Taxed Turbotax Tax Tips Videos

States With The Highest Property Taxes Gobankingrates

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Property Tax What It Is How To Calculate Rocket Mortgage

What Are Marriage Penalties And Bonuses Tax Policy Center

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Fixing The Canadian Species At Risk Act Identifying Major Issues And Recommendations For Increasing Accountability And Efficiency

N J Launches Covid Relief Program For Homeowners Facing Foreclosure Whyy

Fixing The Canadian Species At Risk Act Identifying Major Issues And Recommendations For Increasing Accountability And Efficiency

2b In Nj Tax Rebates To Become Available How To Get Your Share Across New Jersey Nj Patch

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

N J Launches Covid Relief Program For Homeowners Facing Foreclosure Whyy

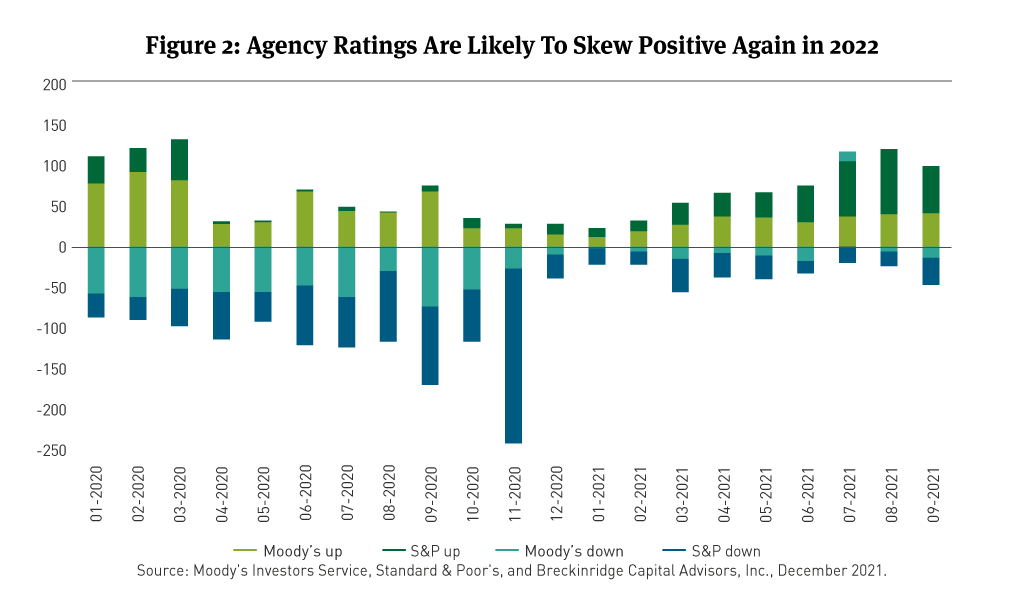

2022 Municipal Bond Market Outlook Breckinridge Capital Advisors